Communication

Investment

Platform

Security

Miscellaneous

Reviews

Compare the wallets

Top WalletsTrezor

Trezor Safe 5BlockStream

BlockStream JadeLedger

Ledger Nano XSafePal

SafePal S1 ProEllipal

Ellipal Titan 2

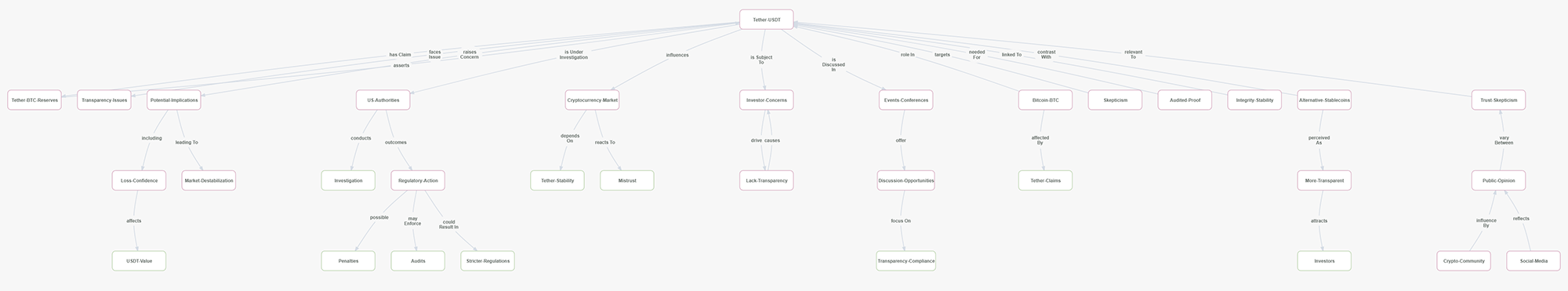

This article captures the main topic: concerns over Tether (USDT) and its claims about Bitcoin (BTC) reserves, alongside ongoing scrutiny by U.S. authorities. The title sets a questioning tone about Tether's legitimacy, suggesting doubts despite Tether's assertions of holding BTC reserves. The introductory paragraph summarizes the core concern: Tether has repeatedly claimed to hold Bitcoin as part of its reserves for USDT. However, with a reported value of $120 billion, questions persist about Tether's transparency and financial integrity, particularly as it faces a probe in the U.S. This introduction situates the article as an investigative piece about Tether’s actual reserves versus its public claims.

This case involving Tether (USDT) is a type of investment scam, specifically related to stablecoin transparency and reserve misrepresentation. Tether claims to back its USDT stablecoin with substantial Bitcoin reserves, but these assertions face skepticism due to limited transparency and inconsistent audits. The U.S. government is probing Tether's practices, which raises concerns about its stability and potential regulatory violations. This lack of clarity can threaten investor confidence and impact the broader crypto market if Tether’s reserve claims are proven inaccurate, making it a high-risk investment scam scenario tied to misrepresentation of assets.

For more insight on investment scams, explore categories related to stablecoin transparency issues and crypto regulation risks.

The article outlines a sequence of events involving Tether’s statements, ongoing U.S. scrutiny, and community responses. It seems that the timeline is built around recent claims by Tether about its Bitcoin reserves, followed by a reaction from authorities and skepticism from the market.

The article investigates Tether's claim of holding Bitcoin reserves for its USDT stablecoin and highlights skepticism around these claims amid an ongoing U.S. regulatory probe. It delves into the potential market impact if Tether’s reserves are not as claimed, underscoring the importance of transparency in the stablecoin market. With references to community reactions and potential legal ramifications, the article reflects broader concerns about the stability and reliability of Tether’s backing.

| Entity | Related Terms |

|---|---|

| Tether | USDT, stablecoin, Bitcoin reserves |

| Bitcoin | BTC, cryptocurrency, digital asset |

| U.S. authorities | regulatory probe, compliance, oversight |

| Crypto community | social media, opinions, reactions |

Using secure hardware wallets can add an extra layer of security by keeping your assets offline and out of reach of online threats. Here are three hardware wallets ideal for holding stablecoins like USDT securely:

In addition to using secure wallets, here are some general tips to help protect against potential scams and secure your assets:

* We get recommendations from the field, they may not be suitable for your particular scenario - but we try to help where we can.