Communication

Investment

Platform

Security

Miscellaneous

Reviews

Compare the wallets

Top WalletsTrezor

Trezor Safe 5BlockStream

BlockStream JadeLedger

Ledger Nano XSafePal

SafePal S1 ProEllipal

Ellipal Titan 2

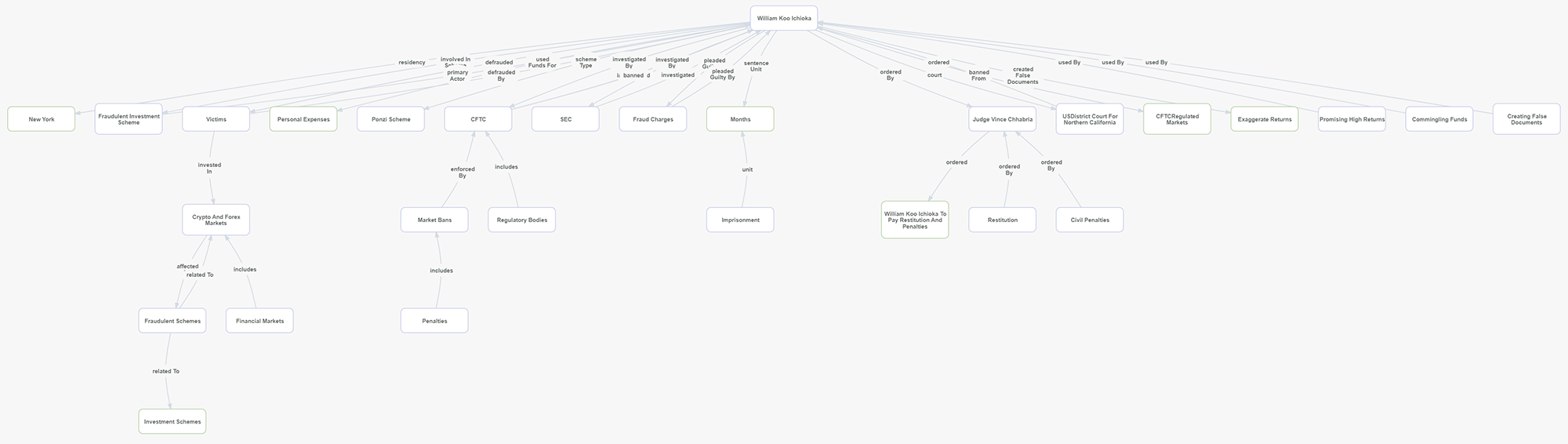

The crime revolves around a crypto fraud orchestrated by William Koo Ichioka, a New York resident, who was involved in fraudulent crypto and forex schemes from 2018 onward. Ichioka falsely promised investors high returns of 10% every 30 working days but diverted funds for personal use, including luxurious living expenses. He was found guilty and sentenced to 48 months in prison, ordered to pay $36.4 million in penalties, with $31 million designated for restitution to victims and $5 million as a civil penalty.

William Koo Ichioka, a New York resident, was fined $36 million and sentenced to 48 months in prison for orchestrating a Ponzi-like crypto and forex investment scheme from 2018 onward. Over 100 victims were defrauded out of more than $21 million, which Ichioka used to support his lavish lifestyle. The CFTC and SEC played a pivotal role in securing justice, underscoring the need for heightened scrutiny of fraudulent investment practices in the crypto space. Investment Scams.

William Koo Ichioka, a New York resident, orchestrated a fraudulent investment scheme promising crypto and forex investors 10% returns every 30 working days. Beginning in 2018, Ichioka solicited more than $21 million from over 100 victims, commingling their funds with his personal accounts and using them to support a luxurious lifestyle. The U.S. Commodity Futures Trading Commission (CFTC) brought a civil case against Ichioka in mid-2023, which culminated in a federal court ruling in September 2024. Ichioka was sentenced to 48 months in prison and ordered to pay $36.4 million, including $31 million in restitution to his victims. This case is emblematic of Ponzi-like fraud schemes that continue to plague the cryptocurrency and forex investment space, leading regulators to prioritize enforcement actions.

| Entity | Related Search Terms |

|---|---|

| William Koo Ichioka | Ichioka crypto fraud, forex scam, Ponzi scheme |

| Commodity Futures Trading Commission (CFTC) | CFTC crypto enforcement, CFTC fines |

| U.S. District Court for Northern California | Judge Vince Chhabria ruling, crypto sentencing |

| Securities and Exchange Commission (SEC) | SEC crypto investigation, SEC fraud cases |

| Ponzi scheme | Ponzi fraud, investment scam, high return promises |

| Judge Vince Chhabria | crypto fraud sentencing, CFTC ruling |

| $36 million fine | crypto penalties, restitution fines |

A hardware wallet could have safeguarded the victims' funds by ensuring that their private keys remained in their control, preventing the fraudulent access Ichioka used to misappropriate their assets.